A major property disaster—be it from a fire, a flood, or catastrophic equipment failure—is one of the most stressful events a property owner or manager can face. In the chaotic moments that follow, knowing what to do is critical, not just for safety, but for ensuring a smooth and successful insurance claim.

This guide provides a clear, actionable roadmap for residential and commercial property operators in Ontario to take control of the situation, meet their legal obligations, and navigate the path to recovery.

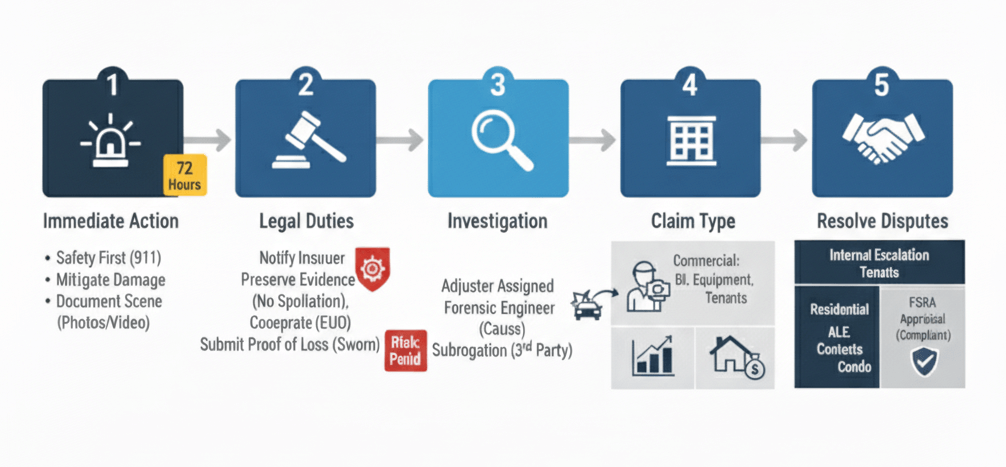

⚠️ Step 1: Immediate Actions in the First 72 Hours

The period right after a large property loss is critical. Your first priorities are safety and control.

- Ensure Safety Above All Else: Your first call should be to emergency services (911) if there is any risk to life or safety, such as fire, structural instability, or electrical hazards. Evacuate the premises immediately if necessary.

- Notify Key Parties: Once the immediate danger is contained, inform essential stakeholders. This includes your insurance broker/provider, property management, and, if applicable, tenants, condo boards, or business partners.

- Secure the Site & Mitigate Further Damage: Once the site is declared safe, you must secure it to prevent further loss, limit liability, and mitigate additional damage. This involves general security measures as well as actions specific to the type of loss. General steps include safely shutting off main utilities like gas, electricity, and water, posting “No Trespassing” signs, and using caution tape to control access.

- Specific mitigation actions include:

- For Water Damage: Shut off the main water supply and contact a professional water extraction and remediation company to begin drying out the property to prevent mould.

- For Fire Damage: Secure the property by boarding up windows and doors to prevent unauthorized entry and weather damage.

- For Power/Mechanical Failure: Shut down affected systems to prevent cascading failures and consult with qualified technicians.

- Specific mitigation actions include:

- Document Everything Meticulously: This is arguably the most crucial step for your claim. Before anything is moved or repaired (unless essential for mitigation), document the scene extensively.

- Take Photos & Videos: Capture the damage from every angle, both wide shots and close-ups.

- Create an Inventory: Make a detailed list of all damaged items, including building materials, equipment, and contents. Note the make, model, and serial numbers of machinery or appliances.

- Keep a Log: Start a journal to track every conversation, decision, and expense related to the incident. Record dates, times, names, and what was discussed.

⚖️ Step 2: Understand Your Critical Legal & Contractual Obligations

Your insurance policy is a contract. After a loss, you have specific duties you must perform to keep your coverage intact. Failing to do so can jeopardize your entire claim.

- Provide Prompt Notice: You must notify your insurer of the loss “promptly.” Do not delay. This official notification triggers the start of the claims process.

- Preserve the Scene & Evidence: The entire loss scene constitutes evidence. Do not discard, repair, or alter damaged property (especially key components like a burst pipe or a failed transformer) until your insurer has had a chance to inspect it. Destroying evidence, even unintentionally, is called spoliation and can be used to deny your claim, as it prevents the insurer from determining the cause of the loss.

- Cooperate with the Investigation: You have a duty to cooperate with your insurer and their appointed adjuster. This includes providing access to the property for inspections, submitting the documentation you’ve gathered, and answering questions honestly. This relationship is governed by the principle of “utmost good faith,” which applies to both you and the insurer.

- Submit a Proof of Loss: The insurer will require you to submit a formal, sworn statement detailing the loss and the amount you are claiming. This is a critical legal document, and there are strict deadlines for its submission.

⚙️ Step 3: Navigating the Claims & Investigation Process

Once the crisis is managed, the formal process begins.

- The Adjuster is Assigned: Your insurance company will assign an adjuster to your case. The adjuster’s role is to investigate the facts of the loss, determine the cause, and evaluate the extent of the damage covered by your policy.

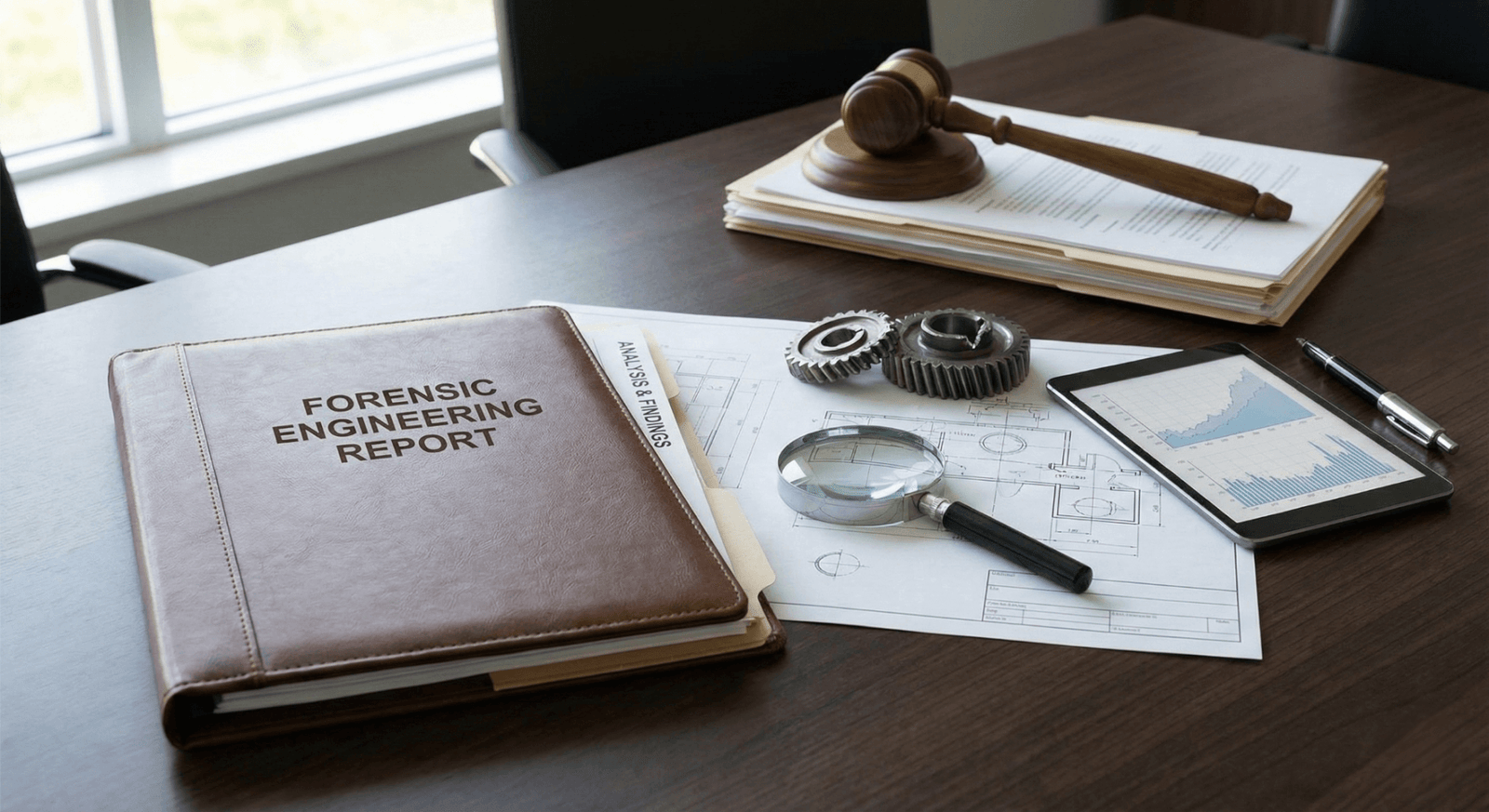

- The Forensic Engineering Investigation: For large or technically complex losses, insurers almost invariably commission a forensic engineering analysis to determine the origin and cause of the failure. The findings can confirm a covered peril, reveal evidence of your own fault (e.g., inadequate maintenance), or uncover that a third party was responsible for the loss. This last finding is crucial as it can lead to subrogation, a process where your insurer, after paying your claim, pursues the responsible third party to recover the costs.

- Your Right to Your Own Expert: You have the right to hire your own independent forensic engineer. This is a critical step if you disagree with the insurer’s investigation results, suspect the findings are incomplete, or want an independent opinion on the cause of the loss. The findings from your own engineer can be used to challenge the insurer’s assessment and support your position in disputes.

- Quantifying the Loss: This is where your detailed documentation becomes invaluable. You will work with the adjuster to scope the repairs and value the damaged property. For commercial properties, this also includes calculating business interruption losses—the income lost and expenses incurred while the property is out of commission.

- Negotiation and Settlement: The adjuster will present a settlement offer based on their investigation and your policy coverage. If you have done your homework and documented your losses thoroughly, you will be in a strong position to negotiate a fair settlement.

🏢 Step 4: Commercial vs. Residential Claims: Key Differences

While core legal principles apply to both, the practical focus of a claim differs significantly depending on the property type.

| Feature | Commercial Property Claim | Residential Property Claim |

| Primary Focus | Business continuity, economic loss, asset replacement | Restoring habitability, personal property replacement |

| Key Consequential Loss | Business Interruption (lost profits, continuing expenses) | Additional Living Expenses (ALE) |

| Documentation Complexity | High (financial statements, payroll, supplier contracts) | Moderate (receipts for personal items, ALE costs) |

| Liability Exposure | Higher (public liability, tenant claims, product liability) | Lower (personal liability, guest injuries) |

| Valuation of ‘Contents | Inventory, stock, machinery, equipment | Personal belongings, furniture, electronics |

| Regulatory Context | Commercial tenancy laws, industry-specific regulations | Residential tenancy laws, Condominium Act |

✅ Step 5: Managing Disputes

Even with diligent preparation, disputes over issues like repair scope, valuation, or coverage denial can arise. You have formal options for resolution.

- Internal Escalation: First, address the issue with your adjuster. If unresolved, you can escalate it to the insurer’s internal complaint officer or ombudsperson.

- The Appraisal Process: For disputes specifically about the monetary value of the loss, the Ontario Insurance Act provides a formal mechanism called Appraisal. Each party appoints an appraiser, and they select a neutral umpire; a decision agreed to by any two of the three is binding on the amount of the loss.

- Regulatory Oversight: The insurance industry in Ontario is regulated by the Financial Services Regulatory Authority of Ontario (FSRA). If you are unsatisfied with your insurer’s internal process, you can file a complaint with FSRA for assistance.

The Insurer Has Experts. Do You?

The outcome of your insurance claim often hinges on one thing: the evidence. The insurer has its experts, and you deserve to have yours.

If you’re facing a large, complex loss and need to determine the true cause of the damage, our team of expert forensic engineers is here to help. We provide the independent, evidence-based analysis you need to ensure a fair and accurate assessment of your claim.

✅ Your Large Loss Management Checklist: A Summary

Feeling overwhelmed? Focus on these key takeaways:

- Safety First: Always prioritize the safety of people.

- Mitigate & Control: Take immediate steps to stop the damage from spreading.

- Document Meticulously: Photos, videos, and lists are your best friends.

- Preserve Evidence: Don’t throw anything away until the insurer sees it.

- Notify Promptly: Inform your insurer and broker without delay.

- Understand Your Duties: Cooperate fully and act in good faith.

When a large loss happens, you don’t have to manage it alone. By following these steps, you can protect your property, fulfill your legal duties, and pave the way for a successful recovery

Contact us today for a confidential consultation and get the clarity you need to move forward.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal advice. The insurance claim process is complex and fact-dependent. You should consult with a qualified professional, such as a property damage lawyer, a licensed public adjuster, or a forensic engineer, to obtain advice with respect to your particular issue or problem. Reliance on any information provided in this article is solely at your own risk.